Posts

Wells Fargo is offering a $125 extra so you can consumers whom generate 10 being qualified purchases by using the the fresh family savings inside 60 schedule days of opening. Certain financial institutions render bonuses to help you new clients so you can persuade these to open a bank checking account or bank card using them. I just enrolled in the newest Chase checking and you may checking account to receive the newest $900 incentive, but had a few pre-determined questions about your conditions. It informs qualify, I have to put a total of $15,100 or more in the the fresh currency for the the new savings account.

What are the criteria to help you be eligible for a checking account bonus?

You simply need to sign up Foster Care and attention in order to Achievement, Alliant’s foundation spouse. As an alternative, for those who work for an enthusiastic Alliant mate otherwise reside in a good being qualified region, you may also meet the requirements as opposed to signing up for Foster Care to help you Achievements. You can generate a sign-right up added bonus once you discover a Revolut membership. You just need to subscribe using another hook from a great Revolut partner to make one to qualifying deal of at the minimum $step one along with your bodily or digital Revolut card. GOBankingRates’ article team is committed to bringing you objective ratings and you may guidance.

$100 Chase Safer Bank account Added bonus

Understand the SoFi Checking & Offers Payment Layer to own details from the sofi.com/legal/banking-fees/. All membership on the our list features lower costs and you will particular earn a high annual payment give (APY), leading them to the best selection to continue using long after your’ve acquired your added bonus. There’s no impact on your credit rating as you’re not receiving that loan or borrowing from the bank. Will they be nevertheless simply using .01% attention with this savings membership, or have the rates gone up to help you at the least full % quantity to the other banking institutions? (My See and you may Citibank savings account is actually one another using more 3.5% currently).

Fifth Third Energy Examining

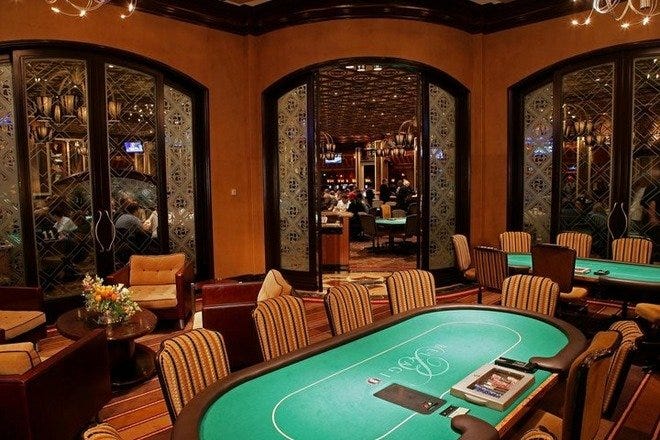

Considering all of our research, their most recent render as high as $900 is a strong bonus one’s higher than regular. Earn a supplementary $eight hundred casino Inter review for those who be eligible for the checking and you will deals bonuses, bringing your full extra to $900. The brand new listings that seem come from enterprises where this site could possibly get receive compensation, that could feeling just how, where along with what buy points are available. Only a few organizations, things otherwise also offers had been reviewed in this regard list. A knowledgeable lender sign-right up incentives is also get you various if you don’t thousands of dollars for those who meet the requirements.

We challenge you to come across any other organization checking account giving that kind of APY. Financial away from The usa’s Cash Benefits Checking includes has such as cashback on the debit credit purchases, which makes it easier for you to earn despite getting the new extra. Amiyatosh Purnanandam ‘s the Michael Stark Professor away from Fund during the Ross College of Organization, College or university from Michigan inside Ann Arbor. Before, the guy served because the couch of your own fund agency so when head of one’s Mitsui Lifestyle Financial Lookup Cardio during the College or university out of Michigan. He has published commonly for the financial intermediation, financial crises, business fund, IPOs and you will credit exposure. His current look targets electronic payments, banking crises, environment fund as well as the communications anywhere between fund and you can community.

Even though both accounts has charge one to add up to $17 a month, you could potentially avoid the Chase month-to-month service charges because of the meeting in the the very least one to status for every type of account. A comparable schedule can be applied for a great Chase personal savings account also. You should buy a plus after all the 2 yrs on the a great consumer family savings. You can get one bonus all the two years for the a business bank account.

Offered to Arizona owners, OneAZ has to offer a $2 hundred greeting incentive after you discover an alternative individual family savings and make use of your debit card. I get every one of these provides to the a size of zero so you can five, following assess the fresh adjusted average to locate a keen account’s final rating. In addition to, you might find one to appointment the advantage criteria helps you make financial punishment. That’s since you may need to establish direct deposits, flow a large lump sum payment on the membership otherwise manage an excellent lowest harmony. Because of the continuing an excellent designs, you might take control of your currency better despite the advantage period. Citibank is offering a $325 extra to possess beginning an eligible savings account and you can and make a few or higher being qualified direct places totaling no less than $step 3,100000 within ninety days.

We’ve game up the best bank account bonuses and you may bank account offers about how to contrast. A knowledgeable bank bonuses for your requirements will depend on your specific economic desires and you can problem. Investigate information about this type of proposes to best know very well what’s best for you. Prior to signing up, check out the fine print and become sensible concerning your capability to be considered.

If you reside in one of the eleven claims Huntington Bank works in the, following that it added bonus is generally a possibility to make some efficiency on your own offers. To earn the bonus, attempt to unlock a precious metal Advantages savings account and you can deposit $twenty five,100000 within the next 3 months. A $600 come back on the a $twenty-five,0000 deposit comes out in order to a great dos.4% go back. That’s much better than the new APY on the of many deals accounts, therefore don’t also need to hold off annually to have it. Which account along with will pay focus on your own balance, that’s an additional cheer.

You could waive Atm charge by sticking primarily for the bank’s Automatic teller machine network. Some banks provide Automatic teller machine commission reimbursements, so you can get reimbursed to possess charges out of additional organization. There is certainly usually a monthly Automatic teller machine percentage compensation limitation, normally only to $10 or $20 per month. Cassidy Horton try a money author layer financial, term life insurance and you will loans.

Yahoo Financing

Someone getting in touch with or messaging both you and saying they’re from Bucks App customer care may also be a scam. There have been instances of people pretending to be Dollars Application help representatives calling directly into query profiles to set up an excellent the new Cash Software membership to resolve an issue, next continuing to scam users out of money. Keep the balance to have 60 consecutive months to earn their incentive. So you can qualify for the bonus, you must play with promo password Q4AFL24 whenever starting the fresh membership, and also the offer is valid thanks to January 15, 2025. Just remember you to incentives are usually tied to carrying attacks, very read the fine print before withdrawing fund otherwise closure an account very early. Lender incentives expose a good chance not just for the payout plus to evaluate-drive a different financial program.

So when you are SoFi’s $50 extra doesn’t hunt valuable at first glance, it earns a top productive APY the brand new closer you are for the lowest direct deposit matter. If we’re judging by productive APY alone, SoFi’s incentive continues to be worth seeking even if you don’t be eligible for a complete $three hundred incentive. Both of these examining account earn focus to your all equilibrium tiers. For many who satisfy these conditions, Pursue have a tendency to deposit the bonus within 15 days pursuing the very first 90-day months.

We didn’t should value month-to-month costs or balancing harmony requirements, and also the no-fee structure of Wise Virtue provided me with satisfaction. Appointment the new direct put requirements is easy, as well as the $300 added bonus is actually credited rapidly. Of course, remember that incentives are nonexempt, so that you’ll have to report it become taxation seasons. The new BMO Deals Builder account will bring a different opportunity to secure up to $60 within the incentives via your first year. Because of the increasing your balance because of the no less than $two hundred monthly, you’ll discovered $5 a month to possess one year. So it construction kits it other than traditional offers profile, which in turn get one-day incentives or need maintaining at least equilibrium to own a-flat period.

PNC gets advertisers a couple of choices to earn incentives from $eight hundred, $five hundred or $step one,000, based on the average daily ledger balance. However, switching the payroll suggestions to improve the direct put is also become a hassle, especially if your financial will not end up being your first lender. For many who in the past finalized the same Pursue account, you may still be considered when the over ninety days has introduced and you also haven’t claimed an account-starting related extra over the past couple of years.